Managing Multiple Bank and Stripe Accounts

Acodei allows you to manage multiple Stripe accounts within a single QuickBooks company. Depending on your configurations and needs, you may want or need to use multiple holding/deposit accounts.

Stripe Accounts

You can connect multiple Stripe accounts in Acodei. Each Stripe account can be managed separately, with its own product mappings and account settings.

Holding and Deposit Accounts

-

Holding Account

-

Tracks your balance inside Stripe before payouts are sent.

-

You can choose to use one holding account for all Stripe accounts or assign a separate holding account for each.

-

-

Deposit Account

-

Represents the bank account where Stripe actually deposits your payouts.

-

In Acodei, you simply map the deposit account to the corresponding QuickBooks bank account so reporting matches your actual deposits.

-

If all Stripe accounts deposit into the same bank account, you can map them to the same QuickBooks account.

-

If they deposit into different bank accounts, assign separate deposit accounts in Acodei to reflect that.

-

Setting Up Multiple Holding/Deposit Accounts

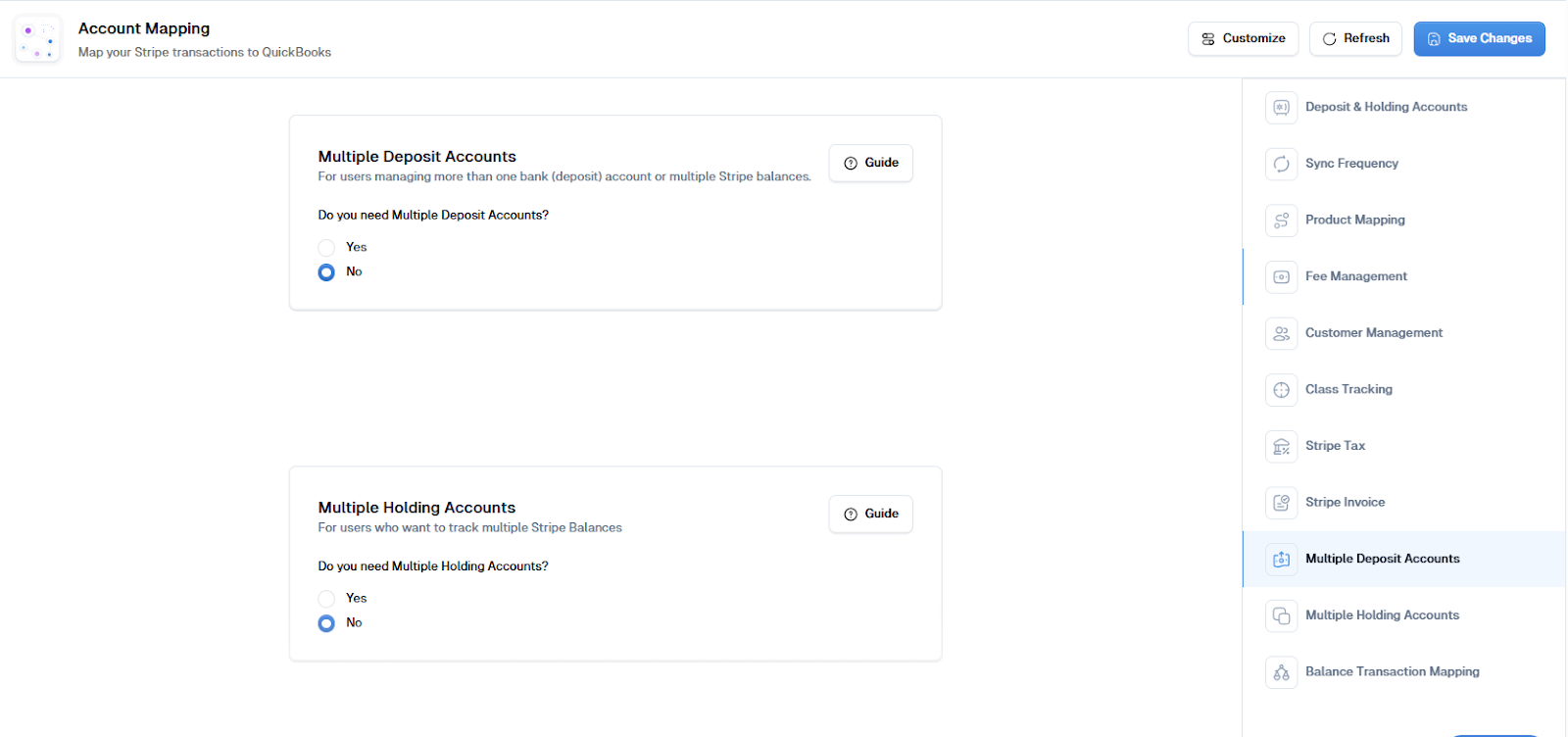

By default, all connected Stripe accounts in Acodei share the same holding account and deposit account. If you’d like to track each Stripe account separately, you can enable multiple accounts:

-

Enable Multiple Accounts

-

Go to the Account Mapping page.

-

Turn on the option for Multiple Holding/Deposit Accounts.

-

-

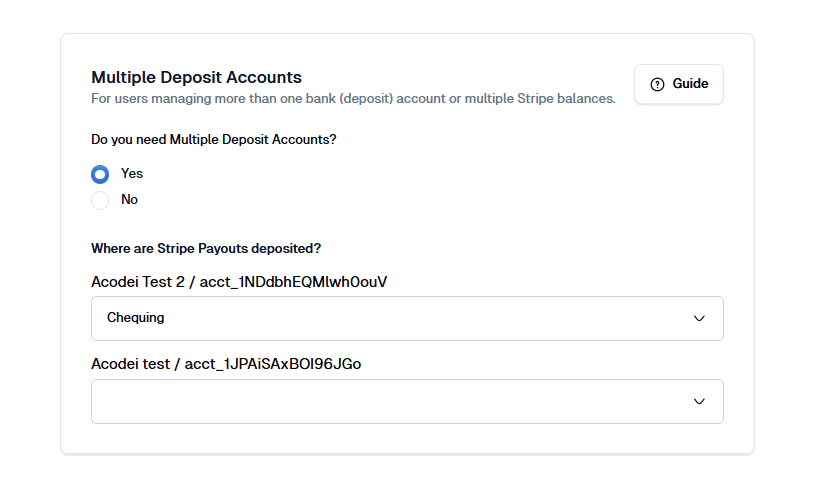

Assign Deposit Accounts

-

For each Stripe account, select the QuickBooks bank account that matches the bank where Stripe deposits payouts.

-

If all Stripe accounts deposit into the same bank, you can map them to the same deposit account.

-

If they deposit into different banks, assign a separate deposit account for each.

-

-

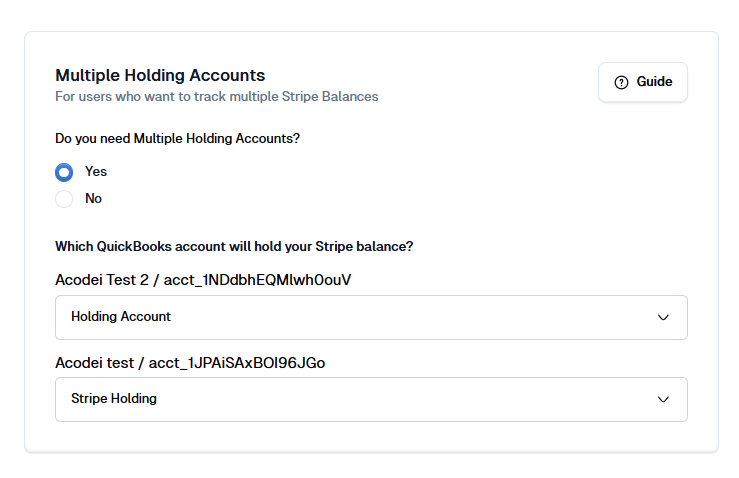

Assign Holding Accounts

-

For each Stripe account, choose a holding account to track Stripe balances before payout.

-

If you are using multiple holding accounts, they must both be Other Current Asset type accounts (cannot use Undeposited Funds).

-

-

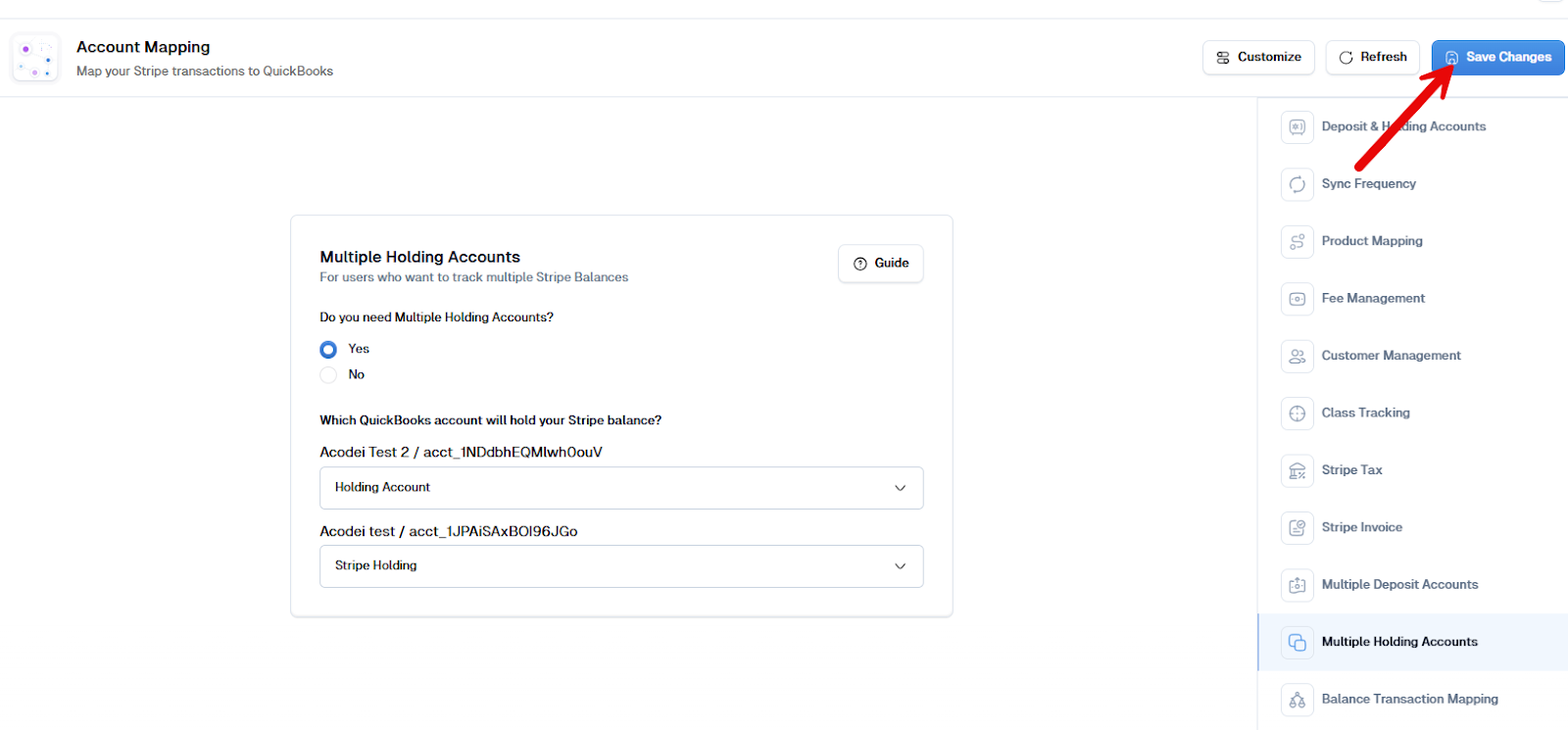

Save Your Changes

-

After assigning the appropriate holding and deposit accounts, click Save.

-

Acodei will use these mappings going forward to ensure your payouts and balances are recorded correctly in QuickBooks.

-

Multiple Product Mapping

-

Multiple Product Mapping is set up per Stripe account.

-

This means you can configure unique product mappings for each account.

- Example: Stripe Account A maps Shipping to “Shipping Expense (5001),” while Stripe Account B maps Shipping to “Shipping Expense (6001).”

Best Practices

-

Match to Real Accounts: Always map your Acodei deposit accounts to the same QuickBooks bank accounts where Stripe deposits the money.

-

Enable Separate Accounts if Needed: If each Stripe account pays out to a different bank, enable separate deposit accounts in Acodei to keep things aligned.

-

Use Clear Labels: Name accounts descriptively (e.g., Stripe – US Holding, Stripe – EU Deposit) so it’s easy to see where transactions are going.

-

Confirm With Your Accountant: They can advise whether shared or separate holding/deposit accounts work best for your reporting needs.